Greater Bay Area Market Update - January 2023

bay area real estate

bay area real estate

Stay up to date on the latest real estate trends.

January 24, 2023

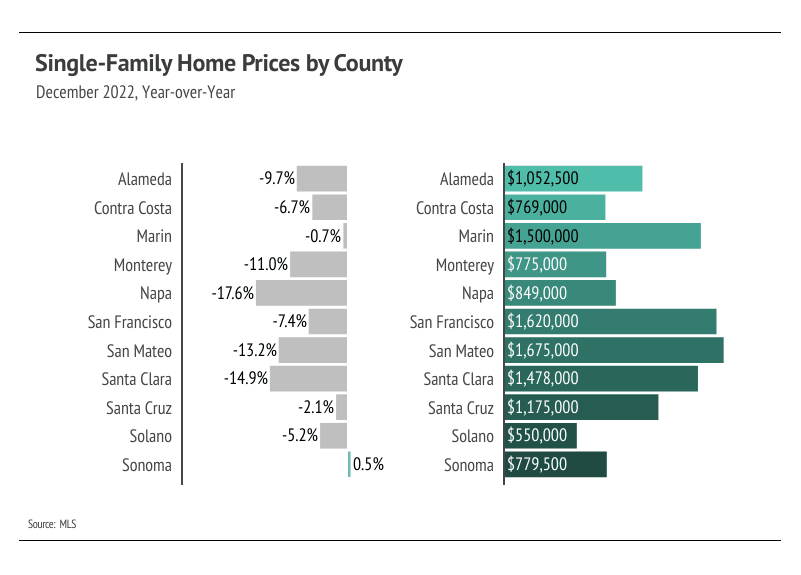

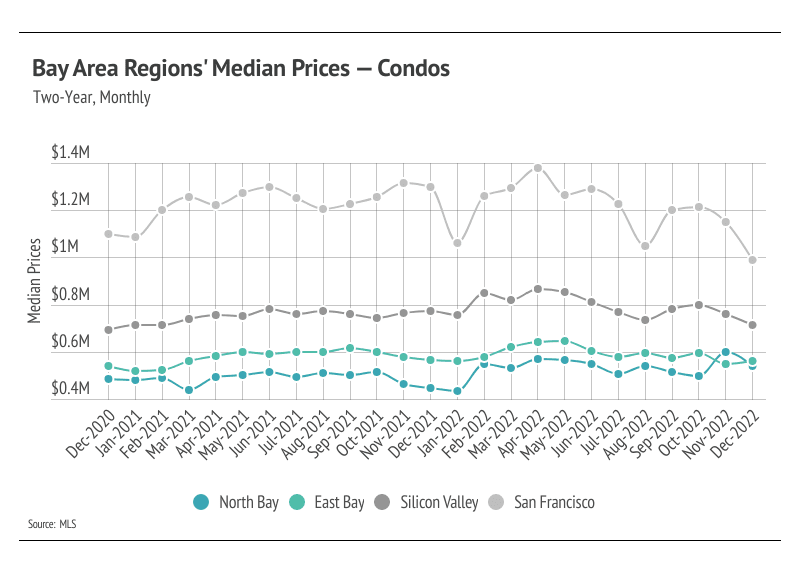

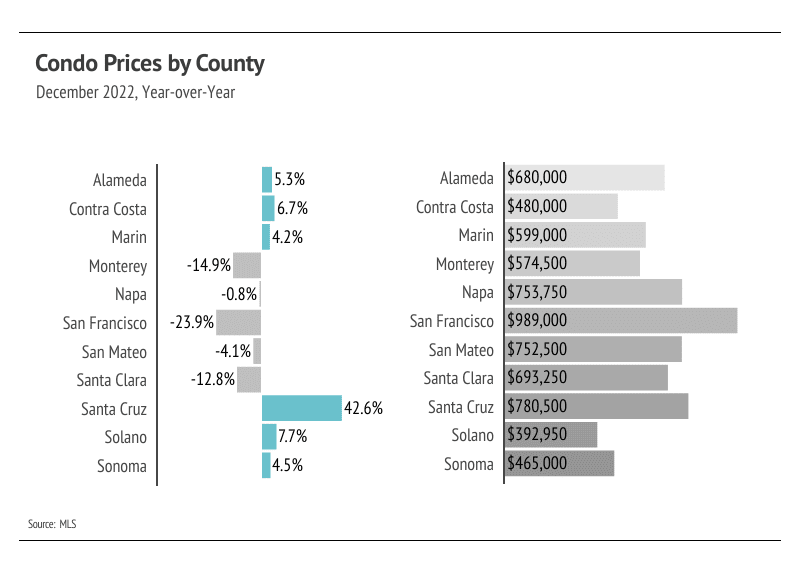

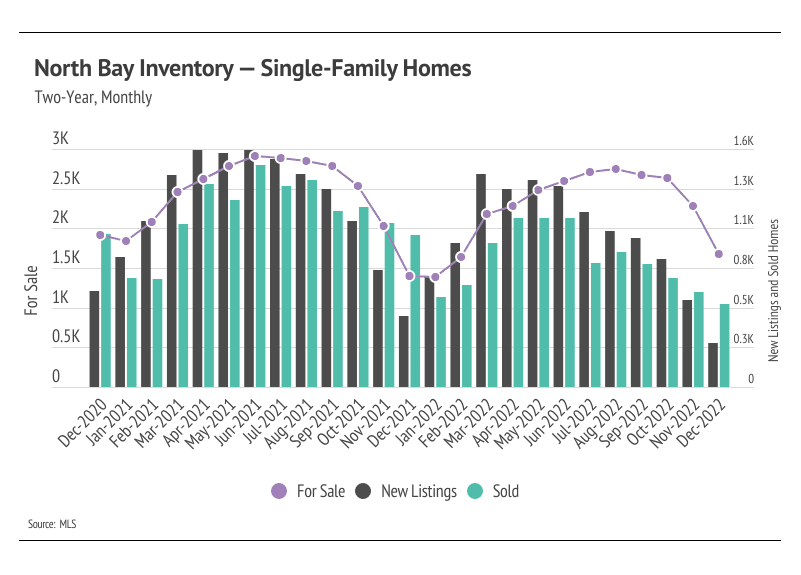

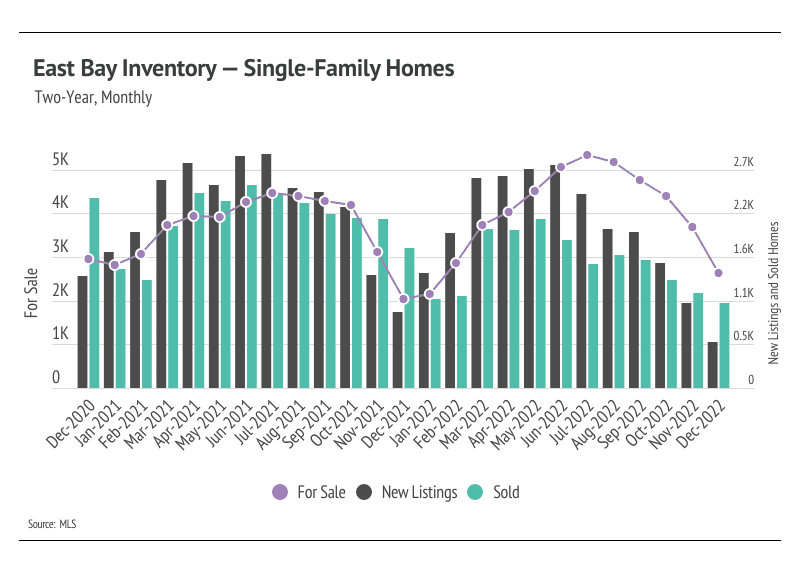

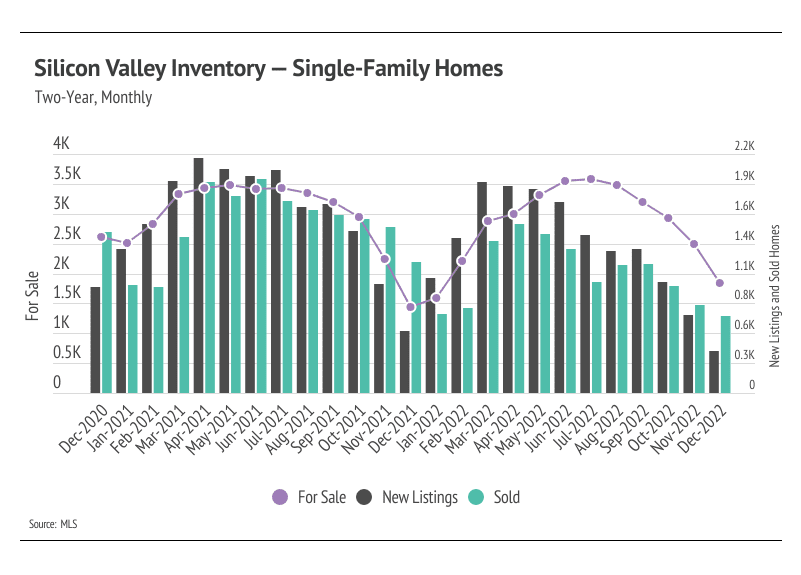

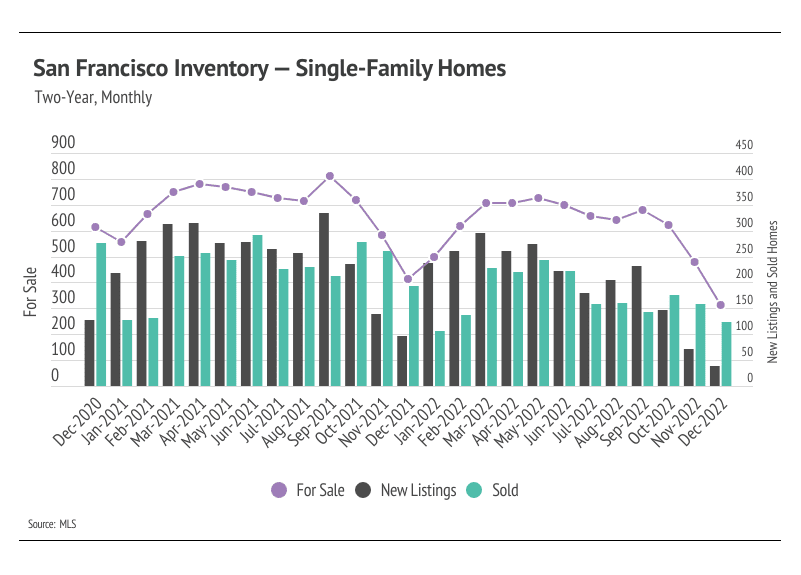

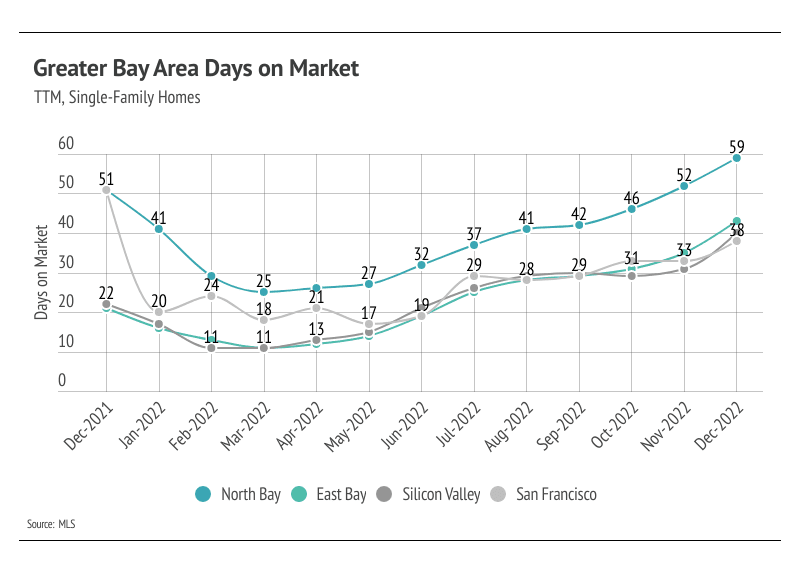

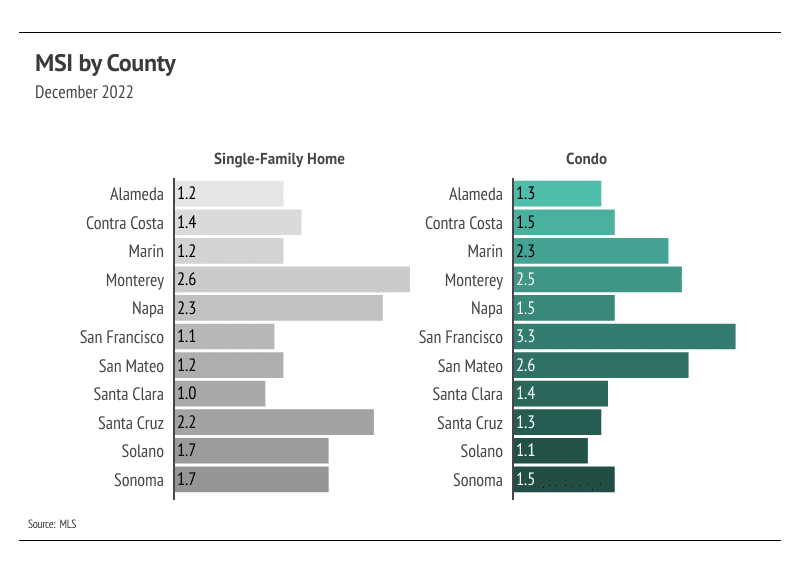

The 2023 housing market is poised to be more balanced between buyers and sellers than it has been over the past three years. Mortgage rates are softening demand, which… Read more

December 16, 2022

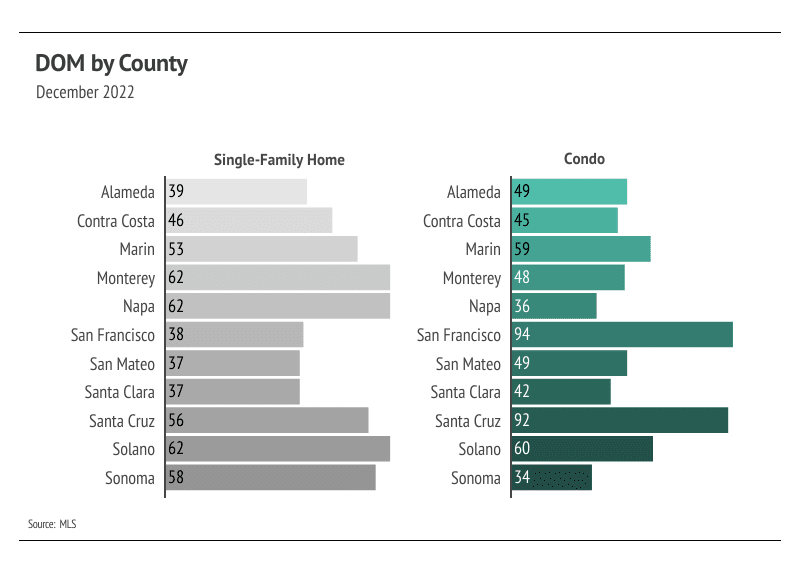

Competition for buyers has decreased as the mix of holidays and higher interest rates dampen demand. Fewer buyers, however, means more opportunities to find the right … Read more

November 18, 2022

With the rise of mortgage rates, many hopeful buyers are pulling back on their house-hunting efforts. Here’s why homebuyers shouldn’t give up the search for their next… Read more

November 16, 2022

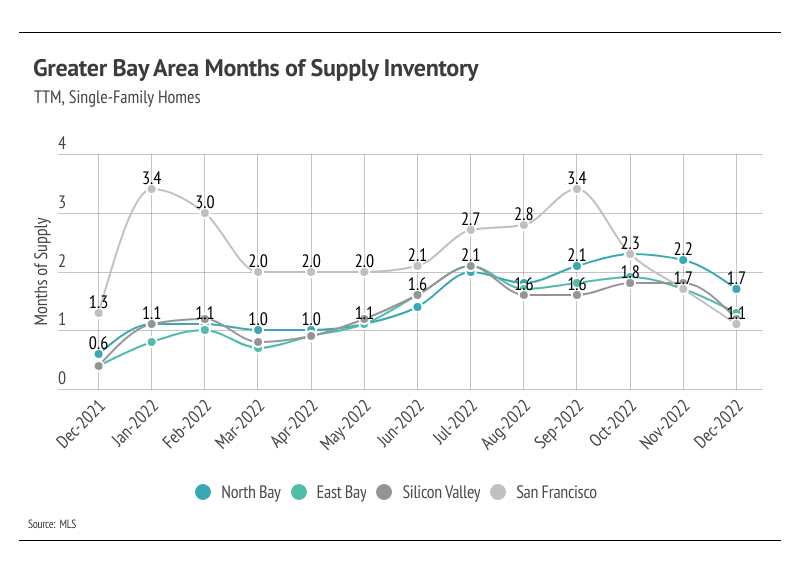

We have enough data to show that the housing market in the Bay Area is cooling substantially after one of the hottest real estate markets in history. However, demand i… Read more

October 25, 2022

September 20, 2022

As we approach the last quarter of the year, we’re sharing an in-depth market update covering the greater Bay Area. At Province Real Estate, our ambitious team of agen… Read more

You’ve got questions and we can’t wait to answer them.